Acquisition Value

MVP to Exit

Merchants Integrated

Daily Transactions

Industry

FinTech / Payments

Company Stage

Startup → Acquisition

Timeline

2016 - 2019

Team Size

10 → 15 Engineers

Outcome

Acquired by Pinelabs

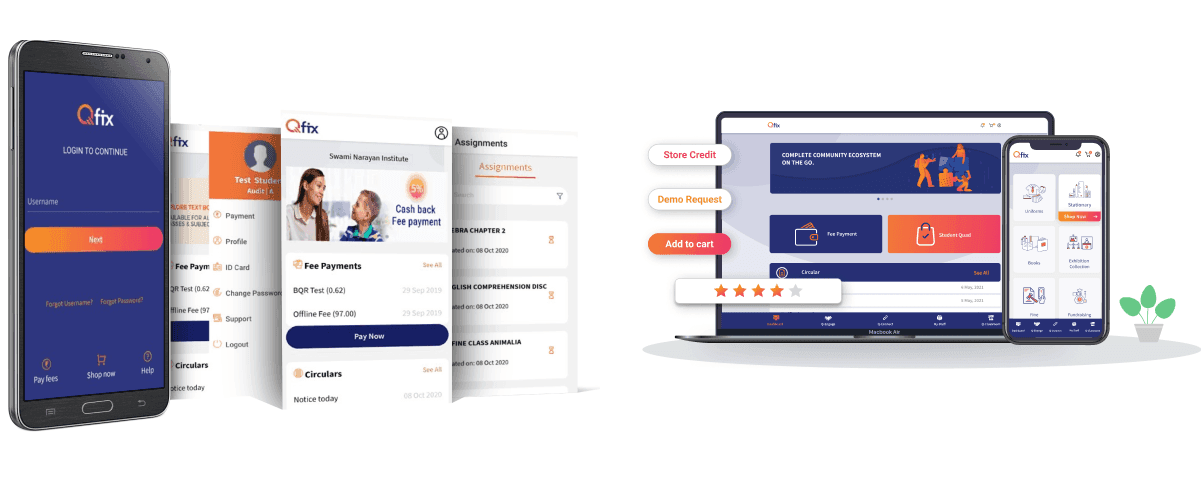

QFix started as a bold vision: to solve the payment reconciliation nightmare that plagued Indian merchants. Every day, thousands of merchants struggle to match transactions across multiple payment gateways, banks, and accounting systems. Manual reconciliation took days, errors cost millions, and cash flow suffered.

The founders came to V2STech with a clear problem but were uncertain about the technical path forward. They needed a platform that could handle complex financial data, integrate with dozens of payment providers, and scale as they grew from 10 merchants to 1000+.

What started as an MVP became a mission-critical platform for India's e-commerce ecosystem, so valuable that Pinelabs, one of India's leading FinTech unicorns, announced to acquire QFix in 2022.

"I have been using their services for the last 36 months. I am highly satisfied with their services, their availability, hard-working attitude, and the culture towards the customer. I will recommend them to everyone looking for similar services like platform and software development. My overall experience has been highly satisfactory."

- Venugopal Choudary, MD, Qfix Infocomm, India

Integrate with 15+ payment gateways (Razorpay, PayU, Paytm, etc.), each with different APIs, data formats, and reconciliation logic. One API change could break thousands of merchants.

Process millions of transactions daily in near real-time. Merchants needed reconciliation reports within minutes, not days. Any delay meant cash flow issues.

Handle sensitive financial data with bank-grade security. One breach would destroy trust. Needed SOC2 compliance, encryption at rest/in transit, and audit trails for everything.

Merchants run 24/7 businesses. Every minute of downtime meant lost transactions, frustrated customers, and churn. Needed 99.99% uptime from day one.

QFix was competing against established players with years of market presence. They had one shot to prove their platform was better, faster, and more reliable. The technical execution had to be flawless; any major bug or outage would kill the business before it took off.

We didn't just build an MVP-we architected a platform designed to handle unicorn-scale growth.

Before writing a single line of code, we spent 2 weeks with QFix's founders and 5 early merchants understanding the reconciliation workflow: how payments flow from customer → gateway → merchant bank account, what data discrepancies occur, and how merchants currently handled this manually.

The technology choices that enabled QFix to scale from startup to acquisition

Understanding payment reconciliation, merchant workflows, technical architecture decisions

Built core platform with 3 gateway integrations. Launched with 10 pilot merchants.

Scaled to 200+ merchants. Added 7 more gateways. Processing 100K+ transactions/day.

QFix went from idea to ₹50Cr+ acquisition in 48 months. Let's discuss how we can help you build a SaaS product that acquirers will want.

Trusted by founders and technology leaders across UK, USA, India and global markets.

We built the MVP with 3 payment gateway integrations (Razorpay, PayU, Paytm) and launched with 10 pilot merchants. The goal: prove the reconciliation logic worked perfectly before scaling.

Once the MVP proved successful, we entered rapid growth mode. Every month brought new payment gateways, more merchants, and higher transaction volumes. The platform had to scale without breaking.

Added 5 more gateway integrations. Scaled infrastructure to handle 10K transactions/day. Implemented auto-scaling on AWS.

Onboarded 200+ merchants. Built advanced analytics dashboard. Added multi-currency support. Processing 100K+ transactions/day

Crossed 1000 merchants. Integrated with accounting software (Tally, QuickBooks). Processing ₹100Cr+ daily. SOC2 Type II certification achieved.

Each payment gateway integration was isolated as a separate microservice. When Paytm changed their API (which happened 3 times in 2 years), only one microservice needed updates—the rest of the platform kept running without disruption.

15 independent services, one per gateway. Auto-retry logic, circuit breakers for fault tolerance.

Core matching algorithms. Handles edge cases like partial refunds, chargebacks, currency conversions.

Generates PDF/Excel reports on-demand. Scheduled daily/weekly summary emails to merchants.

Average Savings per Merchant

By eliminating manual reconciliation staff and reducing payment discrepancies

Faster Cash Flow Visibility

Merchants knew their exact payment status within 15 minutes vs 2-3 days before

Reconciliation Accuracy

Automated matching caught discrepancies humans missed, reducing financial errors

Crossed 1000 merchants. SOC2 Type II certification. Processing ₹100Cr+ daily.

Due diligence, tech handover, ₹50Cr+ acquisition closed. Team transitioned to Pinelabs.